-

Benefits Department office hours

The Benefits Department is located at the ESC in Room 136. Office hours are Monday through Friday from 7:30 a.m. to 4:30 p.m.

Who to contact

-

Jennifer Schroeder, Benefits Manager

- Manages employee insurance and retirement benefits and supervises the insurance operations and staff.

- Monitors all insurance benefits and insurance systems. Works directly with third parties for health, dental, life insurance, long term disability, work comp, online enrollment system.

- Processes all district retirements.

- Staff Wellness Coordinator.

- Troubleshoots claims and billing issues.

When and how to contact Jennifer:

- When planning or thinking about retirement.

- Questions or concerns about insurance benefits.

- jenniferl.schroeder@ahschools.us

- 763-506-1085

-

Chris Sundeen, HR Specialist

- Manages all insurance benefit information for leaves of absences.

- Long term disability.

- Processes work comp payroll adjustments for lost time.

When and how to contact Chris:

- If you have questions about insurance benefits during a leave of absence or questions about how to pay for insurance while on a leave of absence.

- Christine.Sundeen@ahschools.us

- 763-506-1084

-

Lisa Leiner, HR Generalist

- Qualifying life event changes.

- Resignation & COBRA.

- Incident reporting for Work Comp.

When and how to contact Lisa:

- If you have a life event change, questions about resignations or COBRA.

- Lisa.Leiner@ahschools.us

- 763-506-1083

-

Becky Mashuga, HR Generalist

- New employee insurance benefits.

- Orientation Benefits Meetings.

- Daycare flexible spending account.

- Primary care clinic changes.

- Adds newborns to health and dental plans.

- Primary receptionist.

When and how to contact Becky:

- With questions for new hire/newly eligible insurance benefits, adding a newborn to your insurance plans and questions regarding your daycare flex account.

- 763-506-1080

-

Kim Brotkowski, HR Specialist - Leaves of Absence

- Manages all leaves of absences: FMLA, Medical, Maternity/Parental/Adoption/Paternity, Educational, Sabbatical, Military, MN Paid Leave

- Retirements and Resignations

- School Board Agenda (Appendix B)

When and how to contact Kim:

- If you have questions about a leave of absence, contact Leaves@ahschools.us.

- Kim.Brotkowski@ahschools.us

- 763-506-1090

-

Todd Mensink, Director of Labor Relations & Benefits

- Oversees Labor Relations & Benefits Department.

- Chairs District Calendar Committee.

- Works with General Counsel to negotiate and administer Working Agreements and other terms & conditions of employment.

- Facilitates communication between District Administration and bargaining unit leadership.

- Makes recommendations to School Board regarding employee compensation and benefits.

When and how to contact Todd:

- With questions about working agreement language.

- Todd.Mensink@ahschools.us

- 763-506-1142

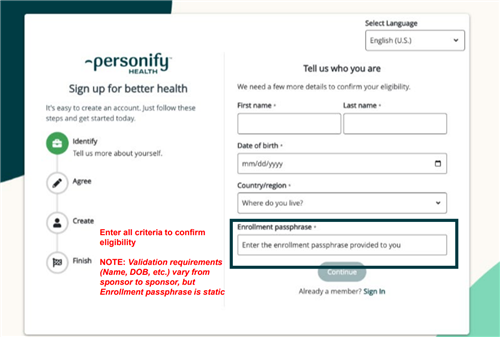

New Passphrase Requirement for My Health Rewards Enrollment

-

My Health Rewards

An important update to the My Health Rewards enrollment process. To enhance account security, members are now required to enter a passphrase during registration. As a result of a recent enrollment issue with Medica’s My Health Rewards portals, which also affects the Personify Health tool, Medica is taking the following step: Members need to add the passphrase “Lets be Healthy 1999” on the enrollment screen. This is a precautionary measure we hope is temporary. Members only need to use the passphrase once when they create their My Health Rewards account. It isn’t necessary after they register.

Effective immediately, the required passphrase is:

Lets be Healthy 1999Enter Medica Wellness in the enrollment passphrase section of the registration page.

Insurance 2025-2026 Benefit Options

-

Insurance 2025-2026

The insurance plan year is September 1 through August 31.

New for 2025-2026

Medica continues to be our health insurance provider. Refer to the 2025-2026 Insurance Benefits Guide to review plan information and rates.The Hartford is our new third-party administrator for Life and Disability insurance. Your coverage includes valuable services that can help you and your family.

How To Choose A Medica Plan

Visit the Welcome to Medica website which provides information on network options, pharmacy benefits and more.Pharmacy benefits

Medica's plans cover a variety of prescription drugs and includes options for filling your prescriptions. If you take prescription drugs, you will want to review how your current drugs will be covered under your new plan to avoid any delays in filling prescriptions.Anoka-Hennepin School’s pharmacy benefit is a three-tier benefit with:

- Generic per prescription unit at a $10 copay

- Preferred brand per prescription unit at a $25 copay

- Non-preferred brand per prescription unit at a $50 copay

Learn more about prescription drug coverage with the Medica plan.

Plan summaries:

Plan documents:

For actively employed policyholders, all deductible plans include a health reimbursement arrangement (HRA). The HRA funds are deposited over 20 pay periods and HRA funds never expire. OneBridge is our third party HRA administrator. You can easily set up an online account to manage your HRA. Contact OneBridge with any questions or for assistance with your HRA at 888-865-1628.

My Health Rewards

My Health Rewards online tool and app lets you log healthy habits, track activity through a fitness tracker, and complete other healthy activities to earn rewards.

Worklife

-

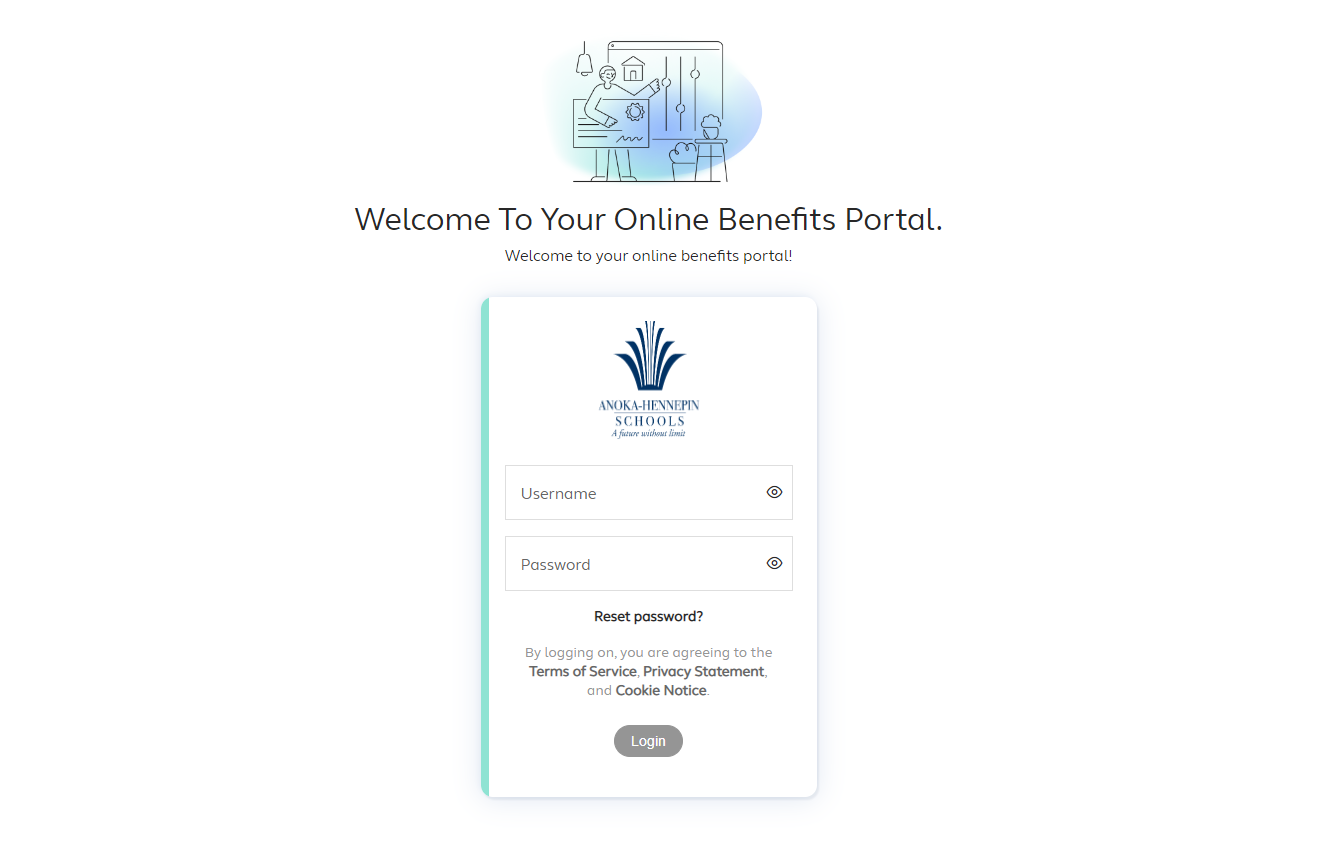

Online insurance enrollment

The site is accessible anytime at ahschools.wl.alight.com/login. It can also be accessed through the A-HConnect login page by clicking the lock in the corner of the district website. After logging in, scroll to the Worklife application.

Worklife login instructions:

Username: Social Security number

Password: Eight-digit birthdate

(No dashes and slashes)

*Access is available to employees enrolled in benefits.

In Worklife, employees can view their health coverage and manage beneficiaries.

Reach out to the Insurance Department with questions at 763-506-1080.

Dental insurance

-

Dental insurance

Eligibility for district dental insurance is defined in the contracts, working agreements or personnel policies for each employee group.Eligible employees may enroll for dental insurance benefits within 30 days from the first day of work in a benefit eligible position or during the open enrollment period, which is held during the month of May of each year.Delta Dental offers you the opportunity to choose from two networks of providers, Delta Preferred (PPO) and Delta Premier. Delta Preferred is going to give you the lowest out-of-pocket costs. It's easy to find a Delta Dental network dentist.Register for your online account and make the most of your dental benefits. Members can visit the Delta Dental website for online tools and resources 24/7. With the Delta Dental Mobile App, you can manage your dental benefits anytime, anywhere.Dental Benefit Plan SummaryThe Delta Benefit Plan Summary helps you better understand your Delta Dental coverage and how it works.

Flexible benefit plan

-

Flexible benefit plan

The Flexible Benefit Plan is available to all insurance eligible employees for pre-tax qualifying expenses as defined by IRS regulations. The purpose of the "Flex Plan" is to increase take-home pay by paying some individual expenses with pre-tax dollars. Eligible expenses include employee medical premiums, medical and dental expenses not covered by insurance, and dependent care/children's day care. By estimating eligible expenses, an eligible employee can set up pre-tax accounts to pay these eligible expenses. Participation is encouraged because of the individual tax savings, but conservative estimates are encouraged because money allocated for these expenses must be incurred during the Flex Plan year or money is forfeited. It is a good idea to estimate expenses on the low side.Eligible employees may enroll in the Flex Plan within 30 days from the first date of work in the benefit eligible position or during the open enrollment period which is held during the month of May of each year. The only other time-limited changes may be made to the Flex Plan is within 30 days of a qualifying life changing event. Qualifying life events are defined in IRS regulations for flexible benefit plans and may include events such as marriage, divorce, birth or death of dependent, death of spouse, insurance change as a result of employment change, change from part-time to full-time status of employees, open enrollment of spouse, or employee taking an unpaid leave of absence. Specific details regarding enrollment and changes are in the Flexible Benefit Plan Description Booklet.

OneBridge is Anoka-Hennepin's admistrator of employee funded flexible spending accounts (FSA). Once you are enrolled with OneBridge, you will receive a welcome email with a link to set up your portal account on YourWay. Log-in to OneBridge's convenient portal to submit a claim.

Employees must enter their flexible spending account elections into the Worklife system for each plan year, i.e. September 1 through August 31.

OneBridge

-

YourWay FSA and HRA

OneBridge is Anoka-Hennepin's administrator of employee-funded flexible spending accounts (FSA) and district-funded HRA (included with your deductible health plan). This year's maximum elections are:

Healthcare flex - $3200 (up to $640 can rollover to the 2025-26 plan year)

Dependent Care flex - $5000Once you are enrolled with OneBridge, you will receive a welcome email with a link to set up your portal account on YourWay. Employees enrolled in FSA or HRA benefits will also receive a Visa Benefits card. Use this card to pay for eligible expenses, you can also submit claims using OneBridge's convenient portal. If an employee makes an election for FSA funds and also chooses a health plan with an HRA, both funds will be deposited into the same account on one card.

Have questions or need help? Call Customer Service at 1-888-865-1628 from 7:00 a.m. to 7:00 p.m. Monday through Friday (Central time).

Life and supplemental life

-

Life insurance benefits

Eligibility and benefit levels for district Group Term Life insurance are defined in the contracts, working agreements, or personnel policies for each employee group. Each eligible employee receives a Certificate of Insurance at the time of enrollment, effective on the first active day at work in a benefit eligible position.

Employees are eligible for Group Term Life insurance benefits on the first day of active employment in a benefit eligible position or during the open enrollment period, which is held during the month of May of each year. Changes in beneficiaries of the life insurance policy can be made at any time. -

Supplemental life insurance benefits

The Supplemental Life insurance plan allows eligible employees to choose the amount of insurance that best suits their needs. This is an employee-purchased benefit administered by Anoka-Hennepin Schools. All premiums are paid by the employee through payroll deductions. Each eligible employee receives the Certificate of Insurance at the time of accepted enrollment. For more details and pricing, see the Supplemental Life FAQs.

Eligible employees may enroll for supplemental term life insurance benefits within 30 days from the first date of hire. Open enrollment for supplemental life insurance does not occur every year, but employees will be notified in the event of an open enrollment opportunity. Changes in beneficiaries of the life insurance policy can be made at any time.

All open enrollment changes take effect September 1. Specific questions may be answered by calling Anoka-Hennepin Benefits Department at 763-506-1080. -

Group term life insurance certificates (Madison National Life)

Long term disability plan

-

Long term disability insurance certificates (Madison National Life)

-

Long term disability plan

Anoka-Hennepin purchases for all full time benefit eligible employees a long term disability plan. Long-term disability insurance benefits may be available for insurance eligible employees who have been actively at work prior to being totally disabled for 90 consecutive calendar days. Accumulated sick leave for any duty days missed during the 90 day elimination period may be used. Beginning on the 91st day the employee will begin to accrue benefits at the rate of two-thirds of the annual base salary.

The employee must apply for Social Security and/or PERA/TRA benefits; and, if eligible to receive benefits, the benefit under the school district plan will be reduced by an equivalent amount so the benefit does not exceed the two-thirds maximum. If eligible for the school district benefit, the employee will receive a benefit check about 120 days after the date of disability.

The Anoka-Hennepin Benefits Department will send the required forms for LTD and information on continuation of health, dental and life benefits upon notification that a medical leave of absence will reach 90 days. Questions regarding long-term disability insurance may be directed to the Benefits Department at 763-506-1080.

Life event

-

What is a qualifying life event?

Here is a list of family status changes that allow you to make a change in coverage:

- Change in legal marital status, including marriage or divorce

- Death of your spouse or child

- Birth or adoption of your child*

- Dependent child turns age 26

- Beginning or ending of employment

- Change in employment status, part-time to full-time or full-time to part-time

- Change in spouse's employment status, new job or loss of job

- Medicare eligibility

You must provide proof documentation of your life event.

-

Next steps?

If you have a qualifying life event, contact Lisa Leiner in the Benefits Department for a Life Event form and/or more information. Direct line: 763-506-1083.

*To add a new baby to your plan, contact the Anoka-Hennepin Benefits Department at 763-506-1080. We will take care of adding your newborn to your health and dental plans. We do not require a form or documentation for adding your newborn.

Employee assistance program

-

Employee assistance program

Medica Optum® Emotional Wellbeing Solutions

Call toll-free 1-800-626-7944 (TTY: 711) for assistance 24 hours a day/7 days a week.

- Do you need help writing a will, finding daycare, college planning?

- Trying to find legal advice?

- Can't seem to relax or feeling anxious?

- Are you trying to quit smoking?

Whether your problem is big or small, Optum is just a phone call away.

The employee assistance program (EAP) is available at no cost to all Anoka-Hennepin employees and their family members. Optum's master's level counseling staff can help you, your family or the other significant people in your life. Identify troubling issues, find resources and learn coping skills or discuss possible plans of action. Your call and conversations with EAP specialists are kept confidential, in accordance with the law.

Insurance Advisory Committee

-

What is the Insurance Advisory Committee?

Health insurance portability and accountability act (HIPAA)

-

Summary of the federal privacy regulations and Anoka-Hennepin's notice of privacy practices

Privacy regulations are part of the Health Insurance Portability and Accountability Act - also referred to as HIPAA. HIPAA will help protect the privacy of your health information as follows:

1. Defines Individual Health Information. HIPAA defines what is considered to be health information.

2. Defines Health Care Organizations. HIPAA directs what kind of organizations must follow standard privacy regulations. HIPAA covers health plans and many other organizations that are involved in the healthcare delivery process.

3. Defines Individual Rights Regarding Health Information. HIPAA provides you with rights to help you understand and control how your health information is being used. The document called Anoka-Hennepin ISD No. 11 Notice of Privacy Practices is distributed to all plan participants. This document explains in detail how Anoka-Hennepin will use and release your health information. Included in this document are descriptions of your rights to:

a) access your health information;

b) request an amendment or correction to your health information; and

c) file a formal complaint if you feel your privacy rights have been violated.Questions or complaints

If you have any questions or complaints, please contact:

Privacy Official

Todd Mensink, Director of Labor Relations & Benefits

2727 N Ferry St. Anoka, MN 55303

763-506-1142

Complaint Contact

Jennifer Schroeder, Benefits Manager

2727 N Ferry St. Anoka, MN 55303

763-506-1085

-

Anoka-Hennepin's commitment to protecting the privacy of your health information

Privacy and security of health information is a concern, which is wide spread throughout the United States. Anoka-Hennepin is committed to protecting private data of its employees including health information. New federal laws call for additional protections of health information as well as provide you with rights to access your health information and understand how it is being used. The Anoka-Hennepin ISD #11 Group Health Plan Participants Notice of Privacy Practices describes in detail how Anoka-Hennepin protects your health information and what your rights are regarding your health information.

COBRA/Minnesota continuation

-

COBRA

Employees who are no longer actively employed by the Anoka-Hennepin Schools are eligible to continue district sponsored Health, Dental, and Life Insurance Benefits for a limited period of time by paying the full group rate premium. Upon notification of eligibility, Labor Relations and Benefits - Insurance Department will send the appropriate information and forms required regarding COBRA, Minnesota Continuation, and HIPAA regulations.

Benefits Manager

-

Jennifer Schroeder

763-506-1085

Jennifer Schroeder

Jennifer Schroeder